Recently we hosted a luncheon for NDIS Leaders with special guest Steven Taylor, Author of NDIS Financial Management: A CFO’s Guide to Operational Excellence. Below are the highlights from this insightful and engaging presentation mostly in his own words.

Leaders in NDIS provider organisations face pressure not only to comply with strict regulations, but also to build workplaces that achieve both financial sustainability and lasting social impact. It's a fundamental balance: providing exceptional care and achieving commercial success.

High-performing providers recognise that financial strength is not the opposite of care. It is the essential foundation that makes care possible.

You can't deliver care without commercial strength

The NDIS operates as both a mission and a marketplace. This environment demands an organisational model where purpose aligns with performance to create truly resilient organisations that can serve participants for the long term.

The current environment for providers has fundamentally shifted:

-

Outcome-Based Funding: Activity-based billing is being replaced with a focus on delivering measurable, positive outcomes for participants.

-

Compliance as Strategic Risk: Regulatory requirements are no longer merely administrative; they are central to operational strategy.

-

Tightening Margins: Rising expectations coupled with sustained financial pressure mean every dollar of revenue and every hour of service must be managed with precision.

It's not about surviving the new environment. The key is to adapt.

The Financial Challenge: When Care Outpaces Commercial Control

Many dedicated providers struggle because their heart for care outpaces their control of core commercial functions. This imbalance leads to instability.

The key risks providers must actively manage include:

| Financial Challenge | Description |

| Cash Flow Volatility |

|

| Documentation Gaps |

|

| Service Balance Risk |

|

Did you know that up to 22% of services go unclaimed due to administrative gaps and poor systems?

The Commercial Mindset Shift: From Reactive Finance to Strategic Stewardship

Commercial awareness must live in every manager.

-

Reporting Foundation: Implement systems for accurate data capture and timely, reliable reporting. You can't manage what you don't measure.

-

Operational Control: Finance must drive compliance and risk management, making regulatory adherence a core operational function, not an afterthought.

-

Strategic Leadership: Real-time visibility changes behaviour. When managers and frontline staff see the numbers daily, they start owning them.

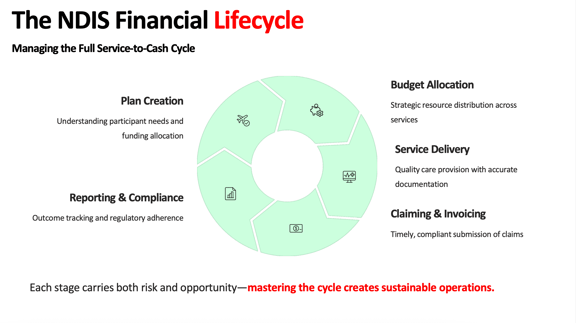

Understanding the NDIS Funding Lifecycle

To truly master commercial sustainability, providers must have a clear understanding of the NDIS funding lifecycle and how each stage impacts financial health.

The Balancing Act: Care and Commercial Success

Achieving the delicate balance between high-quality care and robust commercial success requires proactive strategies:

-

Build Financial Literacy: Educate teams across all service areas on their impact on financial health and sustainability.

-

Forecast Continuously: Move beyond static annual budgets to dynamic, rolling projections that adapt to real-world changes.

The CFO's Practical Toolkit: Essential Tools for Sustainability

The right tools transform organisations from reactive to strategic. Modern NDIS providers need a practical toolkit to drive efficiency and insight:

-

Rolling 12-Week Cash Flow Model: Dynamic forecasting with weekly updates provides critical liquidity visibility.

-

Compliance Dashboard: Real-time monitoring of regulatory requirements ensures proactive adherence and reduces risk

-

Service-Level P&Ls: Granular profitability analysis by service type identifies strengths and areas for improvement.

-

Digital Integration Roadmap: A clear technology plan for automating workflows enhances efficiency and accuracy.

Leading With Heart and Clarity

Financial strength protects care quality and ensures sustainability.

-

Integrate Functions: Unite finance, service delivery, and compliance operations to break down silos and foster collaboration.

-

Link KPIs to Outcomes: Connect financial metrics directly with participant results, reinforcing that care quality and financial sustainability go hand in hand.

-

Sustainability ensures continuity: Long-term viability means being there when participants need you most.

The future belongs to balanced providers. Blending compassion with commercial acumen creates lasting impact.

You can find Steven Taylor, Strategic CFO and Board Advisor on Linkedin.

You can find his best selling book here: https://shop.cfoinsights.blog/

If you'd like to know more about Platform for Care and how our cloud-based CRM will integtrate and simply operations for compliance, rostering, payroll and billing, get in touch today for a conversation with a member of the team.